Contact Us Toll Free

219-362-8567

SYNERGOS Financial Services d/b/a OSBORN Wealth Management is a Registered Investment Advisor currently registered in the states of Indiana and Michigan. The firm provides fee-only portfolio management and advisory services, and is not associated with any banks or broker-dealers. For more information, please view our current ADV filing.

Quick: What is the best thing to do with your 401k or pension? Most folks would say “roll it over into an IRA.” But is a rollover really the BEST option? Not so quick. You have homework to do.

Quick: What is the best thing to do with your 401k or pension? Most folks would say “roll it over into an IRA.” But is a rollover really the BEST option? Not so quick. You have homework to do. A 401k plan and a Roth IRA are slices of two different retirement pies: 401k plans are company sponsored retirement plans, while Roth IRAs are individual retirement plans. Which one is better, really depends on your personal situation. The key to your retirement success, however, is to pull up a chair to this retirement planning buffet and start immediately feasting on one, or both of these great plans.

A 401k plan and a Roth IRA are slices of two different retirement pies: 401k plans are company sponsored retirement plans, while Roth IRAs are individual retirement plans. Which one is better, really depends on your personal situation. The key to your retirement success, however, is to pull up a chair to this retirement planning buffet and start immediately feasting on one, or both of these great plans. At some point, every athlete gives up the chase and steps into the shadows. Greg Maddux gave up the mound after four Cy Young Awards, and Jim Thome left baseball in 2013, after 612 home runs. I appreciate these athletes’ decades-long devotion to excellence, and their dedication to their craft. Their fading prowess kind of invokes that nearly trite investment disclosure: Past performance is no guarantee of future results. For years, I’ve written about balancing intellect and emotion when making investment

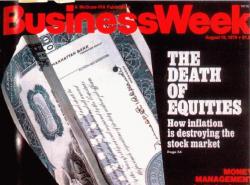

At some point, every athlete gives up the chase and steps into the shadows. Greg Maddux gave up the mound after four Cy Young Awards, and Jim Thome left baseball in 2013, after 612 home runs. I appreciate these athletes’ decades-long devotion to excellence, and their dedication to their craft. Their fading prowess kind of invokes that nearly trite investment disclosure: Past performance is no guarantee of future results. For years, I’ve written about balancing intellect and emotion when making investment There is no risk free investing. Even stuffing cash in the mattress is subject to the risk of a house fire or a bad memory. The single biggest risk to investing? YOU! From 1992 through 2011, the average U.S. equity mutual fund provided total, average annual returns of 8.2%. Over that same period, the average investor’s average annual return — 3.5%.

There is no risk free investing. Even stuffing cash in the mattress is subject to the risk of a house fire or a bad memory. The single biggest risk to investing? YOU! From 1992 through 2011, the average U.S. equity mutual fund provided total, average annual returns of 8.2%. Over that same period, the average investor’s average annual return — 3.5%. The average family is financially dysfunctional. One spouse handles all the financial matters and the grown children have no idea of what mom or dad has planned. Disagree? Then answer this: who can seamlessly step in to pay your bills and manage your portfolio? Is someone in the wings to manage things for your parents when (not if) they can’t manage things on their own? If both answers

The average family is financially dysfunctional. One spouse handles all the financial matters and the grown children have no idea of what mom or dad has planned. Disagree? Then answer this: who can seamlessly step in to pay your bills and manage your portfolio? Is someone in the wings to manage things for your parents when (not if) they can’t manage things on their own? If both answers When exchanged-traded-funds (EFTs) were introduced in 1993, few expected this low-cost index investing idea to explode. But 20 years, and $ 2.3 trillion later, it’s an idea that is here to stay. While many investors gravitate toward the core concept of a broad index (SPY was the first EFT accessing all 500 of the S&P 500 stocks), today’s investors are also interested in satellite strategies focusing on tactical sector investing.

When exchanged-traded-funds (EFTs) were introduced in 1993, few expected this low-cost index investing idea to explode. But 20 years, and $ 2.3 trillion later, it’s an idea that is here to stay. While many investors gravitate toward the core concept of a broad index (SPY was the first EFT accessing all 500 of the S&P 500 stocks), today’s investors are also interested in satellite strategies focusing on tactical sector investing.