Add a Little Fiscal and Physical Health with ETFs (exchange traded funds)

When exchanged-traded-funds (EFTs) were introduced in 1993, few expected this low-cost index investing idea to explode. But 20 years, and $ 2.3 trillion later, it’s an idea that is here to stay. While many investors gravitate toward the core concept of a broad index (SPY was the first EFT accessing all 500 of the S&P 500 stocks), today’s investors are also interested in satellite strategies focusing on tactical sector investing.

When exchanged-traded-funds (EFTs) were introduced in 1993, few expected this low-cost index investing idea to explode. But 20 years, and $ 2.3 trillion later, it’s an idea that is here to stay. While many investors gravitate toward the core concept of a broad index (SPY was the first EFT accessing all 500 of the S&P 500 stocks), today’s investors are also interested in satellite strategies focusing on tactical sector investing.

Fiscal and Physical Health One of the sectors we’re closing following is health care. With a shifting (ok, aging) demographic and a younger population keen on living longer, we see positive short- and long-term

trends. While some investors and advisors might create a portfolio of individual stocks, other individuals prefer broader and more immediate diversification. The iShares U.S. Healthcare (IYH) and the Health Care Sector SPDR (XLV) are two such ETFs offering access t dozens of individual companies. Though we’re not recommending immediate purchase of these funds, we are recommending further research to understand their different approaches to the health care field.

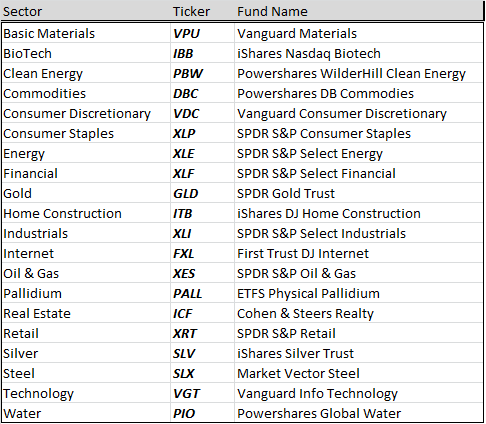

Overweight In spite of mentioning health care, this mention of overweight has nothing to do with tipping the scales. Instead it references allocating extra assets to a specific sector of the economy. Without making any specific recommendations, below are a handful of ETFs that can help investors be nimble and cost-effective with sector investing. We’ve been intentional to list EFTs from a variety of providers to help you learn about the players in this field. Every provider, and fund, differs in the approach to an index, as well as the fees associated with the fund.

Expanding Advisor Options The brokerage industry was, and still is, a commission based business – connecting investors to products, such as mutual funds, for a sales commission. Since ETFs offer no built-in commission structure, the product has remained mostly unknown by the retail investor. Do-it-yourself investors and fee-based advisory shops, such as ours, are the primary users of EFTs. The Do-it-Yourself investor can establish an online brokerage account and pay anything from $0 to $20+ to select and trade an ETF. Someone in need of assistance can employ a fee-based advisor to help manage a portfolio, without conflicts arising over commission-based compensation. So, whatever your investing persuasion, serious investors need to take the time to learn what ETFs can do for a portfolio. You may find your portfolio just a little healthier for having done so.

OSBORN Wealth Management is a fee only advisory firm dedicated to providing conservative asset management, experienced retirement planning and unbiased financial advice. Blog posts are intended for informational and educational purposes, only, and are not an offer to sell. As individual's circumstances are always unique, please consult a professional before embarking on any changes to your investment, planning, tax or legal situation. For questions on this Blog post, or general inquiries about our professional advisory services, please give us a call at 219-362-8567 or email me at drummond@osbornwealthmanagement.com.