What (or who) is the Biggest Risk to Your Retirement?

There is no risk free investing. Even stuffing cash in the mattress is subject to the risk of a house fire or a bad memory. The single biggest risk to investing? YOU! From 1992 through 2011, the average U.S. equity mutual fund provided total, average annual returns of 8.2%. Over that same period, the average investor’s average annual return — 3.5%.

There is no risk free investing. Even stuffing cash in the mattress is subject to the risk of a house fire or a bad memory. The single biggest risk to investing? YOU! From 1992 through 2011, the average U.S. equity mutual fund provided total, average annual returns of 8.2%. Over that same period, the average investor’s average annual return — 3.5%.

The Many Faces of Risk Most risks of investing can’t be avoided, only managed. If you avoid the perceived risks of stock investing, you guarantee the risk of inflation eroding your purchasing power. If you thumb your nose at bank savings rates in favor of long-term CDs, you’ve magnified your interest rate risk The list of risks, over which you have no control, is long and pervasive. The only investing risk, which you have 100% absolute and complete control over is YOU.

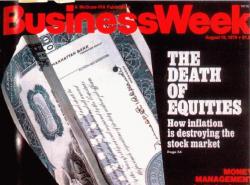

Headline Risk Every child (a slight exaggeration) heard the lesson of headline risk. After all, Chicken Little, (a source of news before the internet) proclaimed, the sky is falling. Step outside the realm of children’s books, and you still find headlines on how that the economic sky is falling. A Business Week cover, from 1979, proclaimed the “Death of Equities”. While inflation was raging at the time, the S&P 500 delivered average returns of 11% for the next 30 years. I’ve avoided more recent “sky is falling” headlines, because too many of you will argue how THIS time is different.

The Power of an Advisor Yes, I make my living, and live my passion, as a financial advisor, but this is not intended as self-serving. Seek out any qualified advisor, vet them, understand their experience, attitudes, approach, and THEN EMPLOY ONE. Why do you think the average investor underperformed the average investment? It wasn’t due to inferior stock picking, it was due to emotions. Individual investors have statistically proven that intellect loses to emotion. Whether you pay your advisor a flat fee or a commission, you can’t measure their value in short-term (or long-term) performance, alone. No, their real value is in managing the risk of YOU. The risk that headlines will drive your investment decisions. The risk that you think you can avoid risk. Sage advice is found in the strangest places, if not fromChicken Little, then maybe from the comic strip character Pogo who said “We’ve met the enemy and he is us.” Sage advice or just funny?

OSBORN Wealth Management is a fee only advisory firm dedicated to providing conservative asset management, experienced retirement planning and unbiased financial advice. Blog posts are intended for informational and educational purposes, only, and are not an offer to sell. As individual's circumstances are always unique, please consult a professional before embarking on any changes to your investment, planning, tax or legal situation. For questions on this Blog post, or general inquiries about our professional advisory services, please give us a call at 219-362-8567 or email me at drummond@osbornwealthmanagement.com.