Cooperstown and the Dividend Psyche

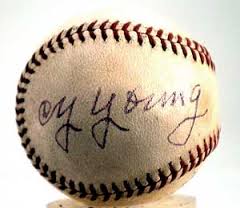

At some point, every athlete gives up the chase and steps into the shadows. Greg Maddux gave up the mound after four Cy Young Awards, and Jim Thome left baseball in 2013, after 612 home runs. I appreciate these athletes’ decades-long devotion to excellence, and their dedication to their craft. Their fading prowess kind of invokes that nearly trite investment disclosure: Past performance is no guarantee of future results. For years, I’ve written about balancing intellect and emotion when making investment

At some point, every athlete gives up the chase and steps into the shadows. Greg Maddux gave up the mound after four Cy Young Awards, and Jim Thome left baseball in 2013, after 612 home runs. I appreciate these athletes’ decades-long devotion to excellence, and their dedication to their craft. Their fading prowess kind of invokes that nearly trite investment disclosure: Past performance is no guarantee of future results. For years, I’ve written about balancing intellect and emotion when making investment

decisions. The balance that allows a portfolio to support needs, and offer tranquil rest (ie. no tossing and turning after watching the business news). How an investment portfolio might grow shouldn’t REALLY matter, just as long as it has that chance to grow. But it does matter. Some investors like the thrill of Facebook shares growing from $18 to $73. Other investors delight in dividends regularly hitting their bank accounts. Share price growth is only a paper profit, until those shares are sold, but dividends can be a tangible reward for investing well done. And while investing is all about increasing wealth (through price appreciation and dividends), many conservative investors prefer the Jerry McGuire approach of “SHOW ME THE MONEY.” The Dividend Kings is an elite list of companies who have paid, and grown, their dividend payments for 50-plus years. Think of them as Dividend All-Stars; the Mr. Octobers focused on one more fall classic. Genuine Parts (GPC) has accomplished this dividend feat for 57 years and Colgate-Palmolive (CL) recently celebrated its 50th year. Stocks can’t be purchased on dividend payments alone, but an annually increasing dividend, supported by a strong balance sheet should pique any investor’s interest. Though there is no guarantee for the next 57 years, I like the fact that 100 shares of GPC paid shareholders $ 198 in 2012 and $ 215 in 2013. And in this low interest rate world, dividend income has moved into the starting line-up. Investing in dividend growth stocks requires the same research and monitoring as any investment strategy. So, be sure to study the scouting reports (and balance sheets) carefully. Home runs and strike outs are part of the game. But, if you’re hoping for a portfolio deserving of a place in Cooperstown, make sure your line-up card is filled with some proven old veterans.

OSBORN Wealth Management is a fee only advisory firm dedicated to providing conservative asset management, experienced retirement planning and unbiased financial advice. Blog posts are intended for informational and educational purposes, only, and are not an offer to sell. As individual's circumstances are always unique, please consult a professional before embarking on any changes to your investment, planning, tax or legal situation. For questions on this Blog post, or general inquiries about our professional advisory services, please give us a call at 219-362-8567 or email me at drummond@osbornwealthmanagement.com.